US, Taiwan Strike Landmark Trade Deal to Cut Tariffs, Spur $250bn Chip Investments

The United States and Taiwan have reached a major trade agreement that will reduce tariffs on Taiwanese goods and unlock massive investment in U.S. technology and semiconductor manufacturing, officials announced Thursday.

Under the deal, Washington will lower the “reciprocal” tariff on most Taiwanese imports from 20 percent to 15 percent, aligning rates with those already secured with key trading partners like Japan and South Korea. Sector-specific tariffs on products such as auto parts, timber and lumber will also be capped at 15 percent, while duties on generic pharmaceuticals and certain natural resources will be eliminated.

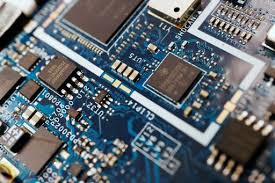

In return, Taiwanese semiconductor and technology firms have pledged at least $250 billion in direct investments to build and expand advanced semiconductor, energy and artificial intelligence production capacity in the United States. Taipei will also provide $250 billion in credit guarantees to support further investment by Taiwanese companies in U.S. supply chains.

The U.S. Commerce Department said the “historic” agreement is designed to strengthen economic resilience, create high-paying jobs and boost national security by spurring a massive reshoring of semiconductor production.

Taiwanese leaders praised the pact as a strategic win that will maintain the island’s continued role as a global chip powerhouse while deepening ties with its most important economic partner. Taiwan’s chip industry, long regarded as the “silicon shield” vital to global technology supply chains, is expected to remain the world’s top producer of advanced AI chips even as investment in U.S. capacity grows.

Officials from China sharply criticized the deal, urging Washington to adhere to the “one-China” principle and opposing any international arrangements involving Taiwan that they see as undermining Beijing’s territorial claims.

The agreement will still require approval by Taiwan’s parliament, where some lawmakers have expressed concern that shifting production overseas could weaken the domestic chip industry in the long run.