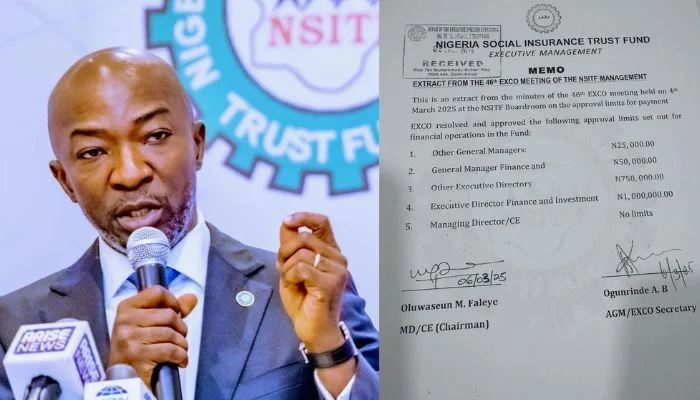

Fresh allegations of large-scale financial irregularities, abuse of office, and governance breakdown have engulfed the Nigeria Social Insurance Trust Fund (NSITF), following a series of petitions by the Arewa Revival Project, a civic accountability and good-governance advocacy group, calling for urgent investigations into the activities of the Managing Director/Chief Executive Officer, Mr. Oluwaseun Mayomi Faleye.

The group has formally written to the Economic and Financial Crimes Commission (EFCC), the Independent Corrupt Practices and Other Related Offences Commission (ICPC), the Office of the Auditor-General of the Federation, the Federal Ministry of Finance under the Whistleblower Policy, the Federal Ministry of Labour and Employment, the NSITF Management Board, as well as organised labour bodies, including the Nigeria Labour Congress (NLC) and the Trade Union Congress (TUC).

At the centre of the controversy are allegations involving the management of approximately ₦297,019,145,288.60 in workers’ funds collected under the Employees’ Compensation Act (ECA) between January 2 and October 9, 2025.

Workers’ Funds, Not Government Revenue

The Employees’ Compensation Scheme is funded through compulsory employer contributions of one per cent of payroll, designed to provide compensation to Nigerian workers who suffer injury, disability, or death in the course of employment.

According to multiple senior NSITF officials cited in investigative reports, the funds administered by NSITF are not government revenue, but trust funds belonging exclusively to Nigerian workers.

“This is not government money. This is workers’ money, contributed mandatorily under the law,” one senior official was quoted as saying. “Every kobo is supposed to be protected by layers of checks and balances.”

₦243.2bn Allegedly Spent Without Board Approval

Documents reviewed by investigators indicate that out of the total inflow of ₦297,019,145,288.60, expenditures amounting to ₦243,203,518,621.17 were recorded within the same period.

Multiple sources allege that a significant portion of this expenditure was carried out without the approval of the NSITF Management Board, in violation of the NSITF Act and existing federal financial regulations.

Officials familiar with the records described the development as a “complete collapse of safeguards” meant to protect workers’ funds.

‘No Approval Limit’ Resolution Raises Alarm

Central to the allegations is an internal document dated March 4, 2025, reportedly extracted from the minutes of the 46th Executive Committee (EXCO) meeting of NSITF, chaired by Mr. Faleye.

According to the document, financial approval limits were set as follows:

- Other General Managers: ₦25,000

- General Manager (Finance): ₦50,000

- Other Executive Directors: ₦750,000

- Executive Director (Finance and Investment): ₦1,000,000

However, under the same resolution, the Managing Director/Chief Executive Officer allegedly approved “no limit” for his own spending authority.

Sources allege that this effectively granted Mr. Faleye unrestricted powers to approve payments of any amount without recourse to the Board or external oversight.

“He simply wrote and signed a document granting himself ‘No Approval Limit’,” a senior official disclosed. “There is absolutely no legal basis for this in the NSITF Act or federal financial regulations.”

Under existing federal thresholds, Managing Directors of government parastatals are reportedly capped at ₦30 million for works and ₦10 million for goods and services, subject to board oversight.

Over 100 Bank Accounts Linked to One BVN

Perhaps the most startling allegation involves the operation of over 100 bank accounts allegedly linked to a single Bank Verification Number (BVN) belonging to Mr. Faleye.

Documents reportedly show that the BVN, registered on June 10, 2015, with Guaranty Trust Bank, Ajose Adeogun Branch, is associated with numerous accounts, some of which allegedly received funds traceable to NSITF operations.

“The scale is staggering,” one insider said. “You don’t run over 100 accounts accidentally. This points to systematic structuring.”

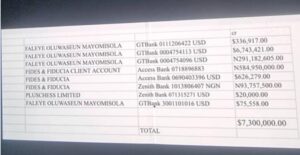

$7.3m and Hundreds of Millions of Naira Traced

In a separate document obtained by investigators, alleged inflows of millions of dollars and hundreds of millions of naira were traced to accounts linked to Mr. Faleye and entities reportedly associated with him.

The transactions listed include:

- Faleye Oluwaseun Mayomisola, GTBank USD Account 0111206422 – $336,917.00

- Faleye Oluwaseun Mayomisola, GTBank USD Account 0004754113 – $6,743,421.00

- Faleye Oluwaseun Mayomisola, GTBank NGN Account 0004754096 – ₦291,182,605.00

- Fides & Fiducia Client Account, Access Bank NGN Account 0718896883 – ₦584,950,000.00

- Fides & Fiducia, Access Bank USD Account 0690403396 – $626,279.00

- Fides & Fiducia, Zenith Bank NGN Account 1013806407 – ₦93,757,500.00

- Pluschess Limited, Zenith Bank USD Account 071315271 – $20,000.00

- Faleye Oluwaseun Mayomisola, GTBank USD Account 3001101016 – $75,558.00

The total dollar inflow alone is estimated at over $7.3 million, excluding naira-denominated transactions.

“These are not small transfers,” a source familiar with the documents said. “The volume, frequency, and structuring suggest deliberate efforts to move and possibly conceal funds.”

₦5.53bn Commission Payments Questioned

Further allegations relate to commission payments totalling ₦5,533,517,486.90, allegedly approved and paid without the consent of the NSITF Management Board or the supervising Ministry.

The payments reportedly include:

- ₦1,379,186,010.00 – Assurance Services ST ADBA Ltd (09/10/2025)

- ₦865,000,000.00 – TAGG Global Resources Ltd (18/03/2025)

- ₦683,777,666.40 – Rate Seal Support & Project Ltd (17/09/2025)

- ₦659,303,810.50 – Rate Seal Support & Project Ltd (16/05/2025)

- ₦648,750,000.00 – Rate Gold Solution Nig Ltd (16/05/2025)

- ₦648,750,000.00 – Gold Solution Nig Ltd (01/08/2025)

- ₦648,750,000.00 – TAGG Global Resources Ltd (01/08/2025)

Sources allege that the commissions ranged between 15 per cent and 20 per cent, and were paid without lawful authority.

Board Absence and Governance Vacuum

Mr. Faleye was appointed Managing Director in July 2023, while the NSITF Management Board was reportedly not constituted until around January 2025, creating a governance gap of over one year.

“The Act expressly forbids Executive Management from spending funds without board approval,” a top official explained. “If there is no board, spending should not take place.”

Arewa Revival Project Condemns Alleged Acts

Reacting to the allegations, the Arewa Revival Project, under the leadership of Hon. Muttakka Ahmed Ibrahim, condemned the alleged acts, describing them as a grave betrayal of public trust if proven.

The group called on President Bola Ahmed Tinubu, as well as all relevant anti-corruption and regulatory authorities, to urgently investigate the allegations to protect workers’ funds and restore confidence in public institutions.

Responses from Officials

When contacted, Mr. Faleye reportedly stated that he was not aware of the allegations. However, when questioned about the dollar accounts and alleged inflows of over $7.3 million, he reportedly ended the call abruptly.

The Permanent Secretary of the Ministry of Labour, Mr. Salihu Usman, reportedly denied prior knowledge of the alleged transactions, while the Chairman of the NSITF Board, Mr. Shola Olofin, requested time to verify the claims.

Presumption of Innocence

All allegations remain unproven and subject to investigation. Analysts note that the unfolding developments represent a major test of Nigeria’s public finance accountability framework, particularly in institutions entrusted with workers’ welfare.

As investigations commence, millions of Nigerian workers await answers over the safety of funds meant to protect them in times of injury, disability, and loss.