Tinubu hails BOI over N636bn loans to 7,000 firms in 2025

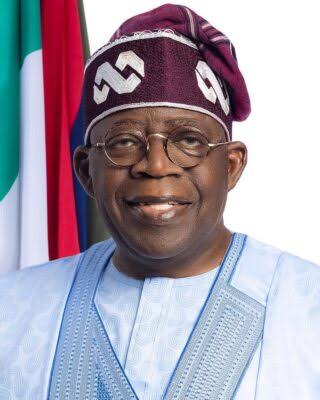

President Bola Tinubu has commended the Bank of Industry (BOI) for disbursing N636 billion to businesses in 2025, the highest annual financing volume in its history.

This is contained in a statement issued by Presidential Spokesperson, Mr Bayo Onanuga, on Thursday in Abuja.

Tinubu said the milestone showed that ongoing macroeconomic reforms were strengthening development finance institutions and unlocking capital for productive sectors.

He said the N636 billion was disbursed to more than 7,000 enterprises nationwide.

A breakdown showed that N202 billion went to agro-allied enterprises, while N100 billion supported critical infrastructure, including broadband, power, aviation and transportation.

Onanuga said that N79 billion was allocated to manufacturing, N77 billion to extractive industries and N55 billion to services.

The presidential aide added that the bank deployed N73 billion in managed and matching funds on behalf of state governments and institutional partners.

“The N636 billion disbursed by the Bank of Industry in 2025 translates directly into productive capacity across Nigeria,” Tinubu said.

He said the disbursement supported agro-processing, strengthened manufacturing output, boosted infrastructure delivery and empowered enterprises across states.

Tinubu said BOI’s inclusion strategy showed in the distribution by business size, with nano enterprises receiving N51 billion and micro businesses N32 billion.

He said small and medium enterprises received N178 billion, while large enterprises accounted for N375 billion.

The president said under the Federal Government’s N200 billion MSME intervention programme, BOI recorded over 95 per cent performance as the disbursing institution.

He said the Presidential Conditional Grant Scheme reached 957,400 beneficiaries in 2025 alone.

Tinubu said BOI’s financing activities led to the creation and retention of about 1.6 million jobs, with support to more than 7,000 MSMEs and 570 startups.

He said women-owned enterprises benefited from the Guaranteed Loans for Women Programme, a N10 billion facility providing up to N50 million per beneficiary.

He said youths-owned enterprises received N12 billion, while 880 rural enterprises accessed over N6.5 billion under the Rural Area Programme on Investment for Development.

The president said BOI-supported interventions included upgrading a tomato processing facility from 3.1 metric tonnes per hour to 10 metric tonnes per hour and linking 47,508 farmers to processing value chains.

He said the bank also supported the deployment of 100 mini-grids, connecting 11,777 new customers and contributing to an estimated annual reduction of over 20,000 tonnes of carbon emissions.

Tinubu said BOI’s asset quality remained strong, with a non-performing loan ratio below 1.5 per cent despite macroeconomic headwinds.

He also acknowledged the €2 billion syndicated facility secured in 2024 and the additional €210 million mobilised from international partners in 2025.

“Development finance must be disciplined, measurable, and aligned with national priorities,” Tinubu said.

He welcomed BOI’s designation as Nigeria’s first National Implementing Entity to the UN Adaptation Fund and its recognition for sustainable finance and inclusion.

Tinubu reaffirmed his administration’s resolve to consolidate reform gains and expand credit access to enterprises to accelerate industrialisation and inclusive growth.