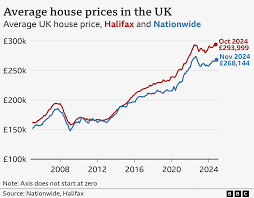

The United Kingdom witnessed an unexpected surge in house prices last month, with figures approaching their all-time high, according to Nationwide Building Society.

The average house price rose by 1.2% in November, marking the largest monthly increase since March 2022. On an annual basis, price growth accelerated to 3.7%, up from 2.4% in October, the fastest annual growth rate since November 2022.

Nationwide reported that the average U.K. house price in November was £268,144, just 1% shy of the peak recorded in summer 2022.

Robert Gardner, Nationwide’s chief economist, described the rise as surprising given ongoing affordability challenges. “House prices remain high relative to average incomes, and interest rates are significantly above pre-Covid levels,” he noted.

Upcoming changes to stamp duty, set to take effect next spring, are unlikely to have influenced the recent growth. Gardner explained that most mortgage applications were initiated before the Budget announcement.

The temporary “nil rate” stamp duty threshold for first-time buyers in England and Northern Ireland will revert from £425,000 to £300,000 in spring 2025.

Despite higher interest rates, housing market activity has shown resilience. Mortgage approvals have neared pre-pandemic levels, bolstered by robust labour market conditions, low unemployment, and strong income growth, even after adjusting for inflation.

The unexpected uptick highlights the continued strength of the U.K. housing market amidst challenging economic conditions.